Digital Treasury Management Services with a human touch

At Texas Gulf Bank, we understand that managing cash flow can be a complex and time-consuming task for businesses. That’s why we offer Treasury Management Services designed to streamline and automate your cash flow processes. Our suite of sophisticated treasury services solutions can help your company reduce operating costs, minimize risk, and expand your reach.

Our Treasury Management Services are fully integrated, offering support for managing cash flow, receiving or paying accounts, and other key business functions. With our solutions, you can maximize funds from collection through disbursement. Let us help you simplify your cash management processes so you can focus on growing your business.

Customized tools and adaptable business solutions at your fingertips

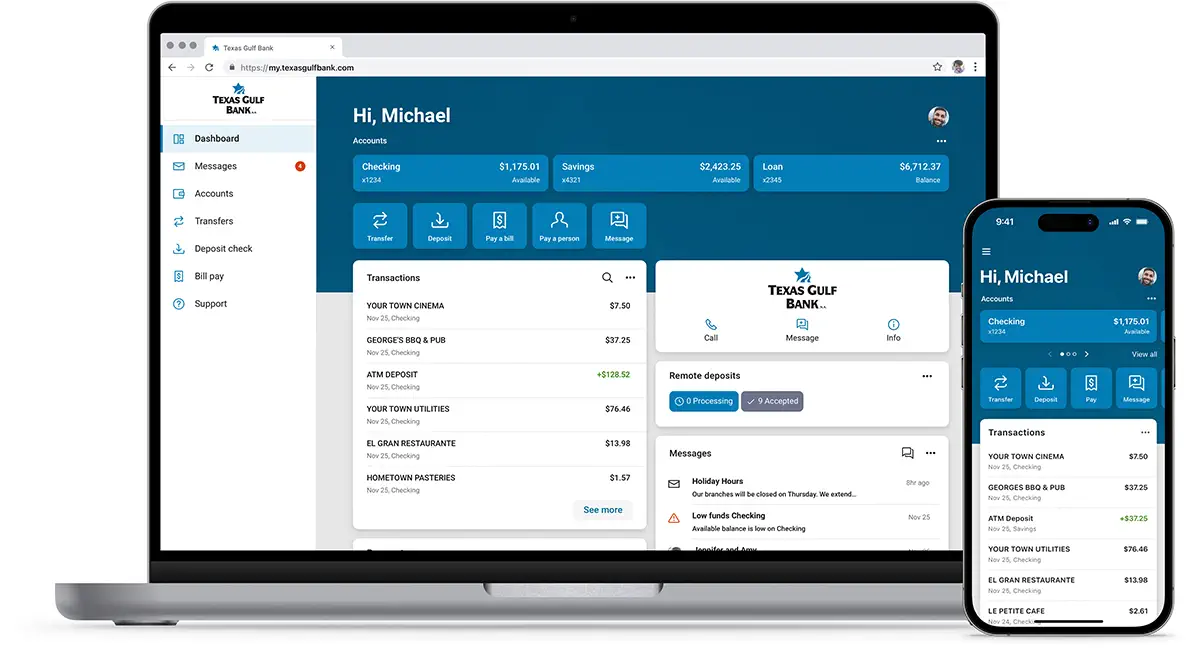

Our Treasury Management Online Banking platform and solutions are available at the office or on-the-go, no matter how you choose to bank.

The platform provides access to your commercial accounts in a secure single sign-on environment with the ability to conduct real-time transactions, including account inquiries, funds transfers, enhanced reporting, and account management capabilities.

Additionally you may choose to enroll in any of our various fee-based Treasury Management Services to be added and integrated to your online banking.

![[bgimage]](https://www.texasgulfbank.com/wp-content/themes/texas-gulf-bank/assets/images/background-image.jpg)